Stock Market Forecasting, using not-usual instruments, because all is One. Focused on the CRUDE OIL, S&P500, Cotton, ASX200, SOYBEANS, CORN, Wheat, Cotton, Live Cattle, 30Y T-Bonds, Gold and Silver - forecasts and strategies ------- Daniele Prandelli - HIGH PROBABILITY TRADING TECHNIQUES

Pagine

Tuesday, November 14, 2017

Monday, October 30, 2017

Allergan PLC Stocks Breakdown, how we trade it

Allergan PLC was a good Stock to open SHORT positions in mid-October, but we were already SHORT from September.

It is easy for everyone to understand why, in October, Allergan is losing so many points. In fact, on Monday... READ MORE

It is easy for everyone to understand why, in October, Allergan is losing so many points. In fact, on Monday... READ MORE

Friday, October 20, 2017

This time I was wrong!

In the last Newsletter, I said I was expecting

a down push, but I was definitely wrong, and the S&P500 went up and

up to new all the time Highs. At least, I gave an interesting level

where we had to protect the position, over 2506 IP; in this way we

closed the SHORT position with a little loss. Actually, at 2511

Futures Points we opened a LONG position, because that was the signal for higher

levels, and we made some profits (even if we closed the LONG position

quite early).

First of all, let me say there are much better

Markets to trade, because a Market with a very low volatility is not good for

traders; I do not suggest to trade the S&P500, or just open

a LONG position and follow the uptrend with a stop below the trendline that

defines the trend. If you want to SHORT the S&P500, wait for a

confirmation, a beakout. With a low volatility, there is no energy to

react at any cycle or change in trend; this is the reality and we better accept

it.

There are better Markets where we are doing

well, like Gold, Soybeans (we are LONG from 922, now at 987),

T-Bonds (we are LONG from 152, it is now at 154)... But there

are also other Markets where we are not seeing any good movement, like Corn

(which is horrible), Wheat, Crude Oil.

This situation, with Low volatility, gave me the time to move to Stocks, and I

have created a new system where I can make money with a lower risk than Futures,

and I can pick up the Stocks that have the volatility I like. The website is

under-construction, but you can already subscriber to it and get the Stocks

Strategy Daily Report for FREE (the Stocks Strategy Daily Report

will be FREE for the next months; we want you to test what we offer before you

spend money for it). The Report is very easy to be read, we just provide precise

signals with stop-loss and take-profit orders.

Friday, September 15, 2017

S&P500 Forecast & Strategy

A constant uptrend, with a low volatility; this is the S&P500 in the last months. What's next? Let's see if I am right: I am expecting to see an imminent down push, I would use a stop over 2506 Index Points, which is a possible resistance area. Any time the S&P500 is under 2506 Index Points, I will be SHORT with the ES.

I do not know how strong the down push can be, but the downtrend should go on until October.

See you in a few weeks...

Friday, July 7, 2017

Is My Work a SCAM or Not?

Is My Work a SCAM or Not?

- I am sorry for this my outburst -

I am sorry, today I feel I have to explain and defend myself, after yesterday, not for the first time, I received an email from a guy that never subscribed my services, telling me that I was offering SCAM, or something similar. This is very annoying for me, I always try to explain in a very honest way everything people ask me. I know there are many SCAMS in this field, and this situation makes people feel as I am one of them.

I am doing the best I can to show not just forecasts, but precise signals based on studies, and who has subscribed my work knows that I have precise rules that I offer in my Daily Report Service. I keep a Trading Record File since 2012 of every signal I offer, hence people could see how I trade, and trust in my work. If this is not enough, in April 2017 I started something that should erase any doubt: I share my screen with Teamviewer to my Daily and Weekly Subscribers, where they can see every day(***), in real-time, the trades I take with the Futures I do personally trade. People can see over the time if I make profits or not; you can see it as a big risk, but I do believe in my work, and I thought this was the best way to help people to understand my strategy, and show them that I do not sell SCAMS. But still, I receive emails like the one I received yesterday. I think I cannot do more than showing in real-time all my trades; what can I do more than that?

One month ago, I was promoting this new skill about my Services, the Screen Sharing (see the Screen Sharing article here), and I gave to possibility to access for one day to everyone; the Account was at 508K USD more or less. This account is now at 523K USD, after one month, which means that the only purpose of trading has been achieved so far, and these are facts that every subscriber of my service could see. What can I do more than that? Showing in real-time all my trading strategy? The Screen Sharing Service is offered subscribing the Daily or Weekly Report Service.

You probably think this is strange, but do you know that most of the times I do not suggest people to subscribe my Daily Report Service, which is the top service I offer? It is because I care of people, and after an experience of 17 years, I understand when someone is ready or not to follow my strategy. Unfortunately, I meet many people that want to trade Futures without having the right knowledge, or funds enough, or time enough to follow the trades. People do not understand this is a job, not an easy way to make extra-money. Actually, trading is an easy way to lose money if you do not do it properly.

I offer different services: Bulletins are based on the forecast, and I provide 4-6 updates per year, but I do not offer I precise constant strategy in this service (this is also why it costs 1/4 the price of the Daily Report Service). Sometimes I also meet people that want to see perfect forecasts, but they do not understand that a perfect forecast does not exist mathematically, and they keep believing in fairy tales; these people are just very lazy, they do not want to work, they want to buy a forecast and make a lot of money with it; trading is not like that, wake up! I do offer forecasts that statistically give good results, but I am aware that they cannot be always right.

A more constant study with a general strategy is released in the Weekly Report, where we update the study and the strategy every week.

To have all the precise strategies every day, I offer the Daily Report Service, where you learn how I do open and close the positions in intraday using a 5-minute chart (Weekly Report included). If you have any question, please contact me.

Trust who shows you facts. The purpose of trading is only one: PROFITS. You should trust who is able to show them, because analysis is not trading, forecasting is not trading; trading is trading, and the result of it is only one final number, you should rely on that number.

(***) The Screen Sharing Service is active every day, but obviously not when I am on holiday, because I do take holidays too, I am human and I need it; or when I do volunteering (last 10 days or August every year); or when I am travelling, not being in my office.

Thursday, July 6, 2017

2017 Bulletins - Now Half Price - See the Results so far

Review of the 2017 Bulletins in the first 6 months of the year

Half Price Now, Order Here:

S&P500

The main trend has been forecast very well.

We had some troubles at the beginning of the year where a drop was expected,

but it never happened. Also, the S&P500 is not easy to trade due to choppy

movements and narrow sideways ranges. We will write a post in the next days

about this situation. Generally, we cannot complain about the forecast,

suggesting very well the main trend. What’s next? Order now the 2017, Half Price for the last 6 months of the Year.

Cotton

The Cotton PFS did a great job until May,

even if it has missed the top of May due to unexpected news. As you can see,

the forecast also hit perfectly the top of March 2017. In the Bulletin we

managed every movement with precise levels. For example we said to use the

levels 79.54 to follow the up push above it, and take some profits, or to use

75.70 to close any LONG position under it, because under it the situation could

turn very negative. You can Order Now the 2017 Cotton Bulletin at Half Price.

Live Cattle

Great job with Live Cattle, where we could

follow a great up push at the beginning of the year. Then, we had to deal with

the up push of the end of April/beginning of May, not easy due to a high

volatility in intraday, but we used it as a new opportunity to open SHORT

positions, bringing to us new good profits. Order Now the 2017 Live Cattle Bulletin, Half Price.

Corn & Soybeans

The forecast worked very well, we cannot

complain about it, but we had to deal with a never ending sideways pattern. It

is not easy when the Market remains in such a narrow range for 8 months! But

the forecast helped us to take some profits, even if not big due to the lack of

swings.

With Soybeans we had a great forecast,

except for the period from 16 February to 31 March; our forecast model

suggested an uptrend, but the Market pushed strongly down in that period.

Obviously I had some losses, but thanks to our strategy we used intelligent

stops to protect the positions.

From April, the forecast is back to work

very well, and we believe it will continue for the rest of the year, even

because we have a great price map that is working perfectly, helping us to open

and close our positions at important Key Levels.

Tuesday, March 14, 2017

Waiting for the FOMC, the new Cotton Forecast is working...

The S&P500 is not doing any movement, not a good Market to make money, but there are other Markets we should follow; profits are profits, no matter from where they are coming...

In trading it is normal to get attached to a Market. I was in love with the S&P500, then I discovered Grians Markets, then other Commodities, and now I love all of them. Being in love with only the S&P500 is not a good thing on these days, because the low volatility is the worst enemy for a trader; we all know the volatility of the S&P500 is really horrible right now! But tomorrow the wind will change due to the FOMC Statement; also many grains markets, like Wheat and Corn, are not offering a good volatility.

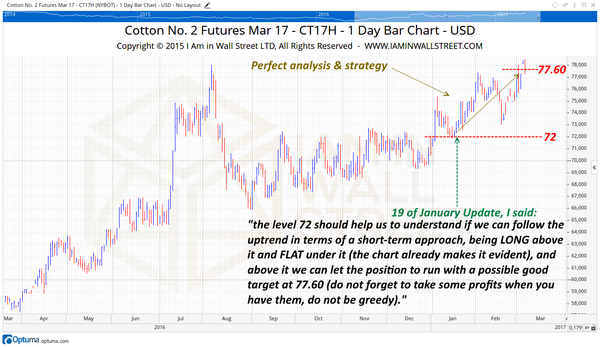

In 2017 we have introduced a new Market: Cotton. We provide a forecast model with constant updates over the year. The first update was on the 19th of January 2017, you can download it in this page:

If you read the Update you see we said to expect an uptrend, where we had to buy with stop under 72, and possible target in area 77.60. The strategy was perfect (we are not trading the March 2017 Contract anymore, the May Contract details are in the last Update).

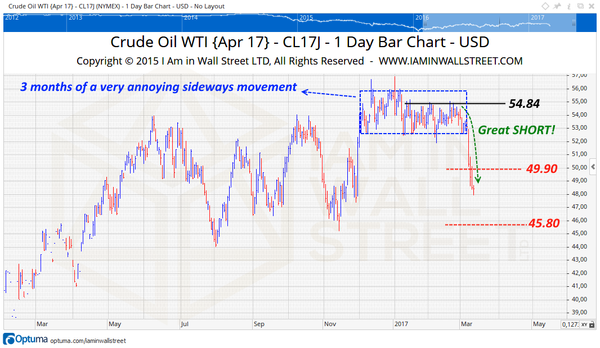

Another good Market, but very hard to handle, is Crude Oil WTI. We said to expect a descent from this Market, and I said it 3 months ago! Unfortunately there was no point to see the end of a never ending sideways movement... until last week!

In our Reports, we said to use the April Contract with the Key Price 54.84, always SHORT under it and FLAT above it. The strategy was good, and not so hard to understand! We said to play with the Market under 54.84, opening SHORT positions at the resistance and taking some profits at lower levels, but remaining always SHORT with a part of the investment because of the expected down trend. It was a long wait, I know, but totally worth in the end! The levels in red are the possible mid-term levels where to find supports/resistances.

We deal with different Markets, and this is good when we have to manage a big portfolio. We have closed a great trade with Gold, from 1180 to 1258, but it is a lie if I tell you that in the last months we made money with every Market we trade! Grains have a low volatility, Soybeans are better than Corn and Wheat, but very choppy anyway, so, no easy to handle then. The good thing is that we keep under cotrol the losses during hard moments, and we let the profits to run with those Markets that have favorable conditions. Even the Stocks Market acted in a very strange way in the last few months (I'm talking about the US Market), we will speak about it in the next newsletter.

Contact me for any question you have: info@iaminwallstreet.com

If interested in our other studies and services, please visit the website:

You can read the previous Newsletters following this link:

Best Regards,

Daniele Prandelli

I Am in Wall Street Ltd

e-mail: info@iaminwallstreet.com

Skype: I Am in Wall Street

http://www.iaminwallstreet.com

http://www.iaminwallstreet.com

High Probaility Trading Techniques - S&P500, 30 Year Treasury Futures Bonds, Crude Oil, Gold, Corn, Soybeans, Wheat, Forex, Stocks, Silver, Live Cattle and S&P/ASX200.

Tuesday, February 28, 2017

Tradersworld Magazine - Article

Hey guys, here you can read the

TRADERSWORLD MAGAZINE

Between many articles there is also

one of them

that speaks about my work

at page 31

In the Article I show the importance of the level 20.000 points of the Dow Jones Industrial Average Index. As you can see, it was a perfect resistance and the breakout of it was a strong bull signal. Right now, we have the same important level at 2370 points of the S&P500 Index (as I said in the last week)... I am just sayig that... use it as a guide! ;)

Contact me for any question you have: info@iaminwallstreet.com

If interested in our other studies and services, please visit the website:

Monday, February 13, 2017

Subscribe the Daily Report - Special Gift for you!

SPECIAL OFFER

Included in the Daily Report,

"How to Trade to Make Profits" - E-Book!

A book that shows 1000 trades

I made in 3 months,

turning 40,000 USD in 64,000 USD,

with a performance of +58%!

In the e-book I explain how I open and close the trades that allowed me to get this performance, made with real money trading Futures.

INTERESTED IN OUR 2017 FORECASTS? NOW YOU CAN DOWNLOAD THE ORIGINAL 2016 BULLETINS AND UPDATES

2016 S&P500 FORECAST BULLETIN:

2016 CORN & SOYBEANS FORECAST BULLETIN:

You can find our services here: Service page:

Daily Report Service - The premium service

Weekly Report Service - Reports and studies every week.

Friday, January 13, 2017

2017 SOYBEANS FORECAST - IS IT RIGHT?

How many opportunites do you want to miss in 2017? And

let me tell you this is just the beginning, the biggest movement has still to

come! Will it be up or down? And when will it happen?

**************

WE ARE

TRADERS! WE TRADE OUR STUDIES BECAUSE WE TRUST IN OUR WORK

Here below

is a screenshot from a Live Tradestation 9.5 Account, and you can see we made

two simple trades with Soybeans since the 2017 began:

You can find our services here: Service page:

Daily Report Service - The premium service

Weekly Report Service - Reports and studies every week.

Thursday, January 12, 2017

2017 COTTON FORECAST

ARE YOU READY TO KNOW IN ADVANCE

THE MOST FAVORITE TRENDS FOR THE 2017?

Check out here below how the forecast model worked in the previous three years!

This is the 2014 Cotton Chart VS. the 2014 Cotton Forecast Model:

There is no reason to explain anything; the 2014 Cotton Forecast Model was just perfect.

This is the 2015 Cotton Chart VS. the 2015 Cotton Forecast Model:

The 2015 was not an easy year; you see how many choppy movements we had to deal with! But still, as I said before, the Model was able to forecast the main trend of the year.

This is the 2016 Cotton Chart VS. the 2016 Cotton Forecast Model:

The 2016 Cotton Forecast Model was able to forecast the main trend of the year, but we had probably some troubles in July due to a strong fast up push, lasting just 3 days. The dots blue line tries to simplify the model, showing how the main trend was the real one we had to follow, and even if we had to suffer in July, with patience we could make very good profits! A constant uptrend started in February as suggested by the forecast, and even if we were about to close the position at the beginning of July, it was a great trade anyway. We cannot trade every swing buying at the Low and selling at the Top!

If you are a Cotton Trader, you cannot miss the chance to order the 2017 Cotton Forecast Model - ORDER NOW

You can find our services here: Service page:

Daily Report Service - The premium service

Weekly Report Service - Reports and studies every week.

2017 S&P500 Forecast Bulletin

2017 Corn and Soybeans Forecast Bulletin

2017 Live Cattle Forecast

Contact me for any question you have: info@iaminwallstreet.com

If interested in our other studies and services, please visit the website: www.iaminwallstreet.com

You can read the previous Newsletters following this link: http://archive.aweber.com/awlist3900413

Best Regards,

Daniele Prandelli

I Am in Wall Street Ltd

LinkedIn: https://www.linkedin.com/in/daniele-prandelli-3aab15112

e-mail: info@iaminwallstreet.com

Skype: I Am in Wall Street

http://www.iaminwallstreet.com

High Probaility Trading Techniques - S&P500, 30 Year Treasury Futures Bonds, Crude Oil, Gold, Corn, Soybeans, Wheat, Forex, Stocks, Silver, Live Cattle and S&P/ASX200.

Subscribe to:

Posts (Atom)